EMIR Refit introduced a mandate in EMIR for ESMA to periodically review the clearing thresholds and update them where necessary, in order to ensure that the thresholds remain appropriate. ESMA was seeking feedback on the hedging exemption, equivalence and the level of each clearing threshold per derivative class and the treatment of financial (FC) and non-financial counterparties (NFC).

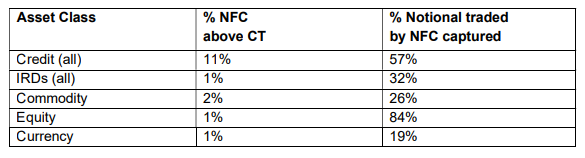

The report shows that under the current regulation, the percentage of NFC that is subject to clearing is 1% to 2% for most asset classes. The only exception is the credit derivatives where 11% of the NFC is required to clear its positions. This emphasizes the view that the vast majority of NFCs enters into derivative contracts for hedging purposes. The notional captured by the NFC that do need to clear their derivative positions shows big differences between asset classes. For currency derivatives only 19% is captured, while for equity derivatives it is 84%.

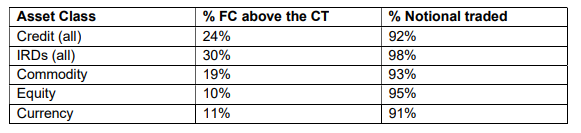

In line with expectations, the numbers are quite different for FCs and show a consistent distribution. About 10% to 30% of the FCs per asset class are subject to the clearing obligation, but the clearing subsequently captures over 90% of the notional traded in each asset class. An indication that the larger players in the market are responsible for almost all market activity in each asset class.

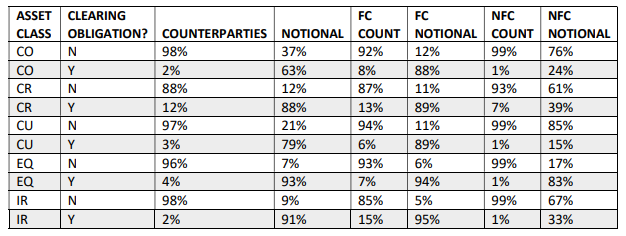

ESMA also conducted a sensitivity analysis regarding the level of the clearing thresholds. Under the existing regulation the clearing threshold for equity and credit derivatives is 1 billion and for interest rate, commodity and currency derivatives the threshold is 3 billion. That results in the below distribution of clearing requirements. ESMA then analysed three scenarios for changing the level of the clearing thresholds:

· Scenario 1 – Decrease of all thresholds by 0.5 billion. This would cause very little change in both the counterparties and notional captured by clearing. The biggest change was observed for credit derivatives held by NFCs which as an asset class is not so impactful from a systemic risk perspective.

· Scenario 2 – Increase of all thresholds by 0.5 billion. Again the impact on both counterparties and notional captured was very small. The most significant move was that 3% less notional traded by FCs would be in scope for the clearing of credit derivatives.

· Scenario 3 – Increase of all thresholds by 1 billion. Also in this scenario, the impact would be limited and again the most important change would be related to credit derivatives where around 5% of notional traded would no longer be in scope for clearing.

The DACT has supported the EACT in its response document. The EACT believes the current regime should be maintained, a more regular dialogue between ESMA and end users of derivative products should be established and a long-term solution to the uncertainties following the UK withdrawal from the EU should be found.

In case you feel that the DACT can contribute in this process via webinars or an active exchange of information, please contact your DACT representative via:vaktechniek@dact.nl