Draft Guidelines on common procedures and methodologies for the supervisory review and evaluation process (SREP) and supervisory stress testing under Directive 2013/36/EU

These guidelines are addressed to competent authorities and are intended to promote common procedures and methodologies for the supervisory review and evaluation process (SREP), which is an ongoing supervisory process bringing together findings from all supervisory activities into a comprehensive supervisory overview of an institution. These guidelines also aim at achieving convergence of practices followed by competent authorities in supervisory stress testing across the EU. As such theoverall aim of SREP is to ensure a comprehensive assessment of a (financial) institution, allowing competent authorities to form a fully-informed view on the viability and sustainability of the institution and on the application of adequate supervisory measures.

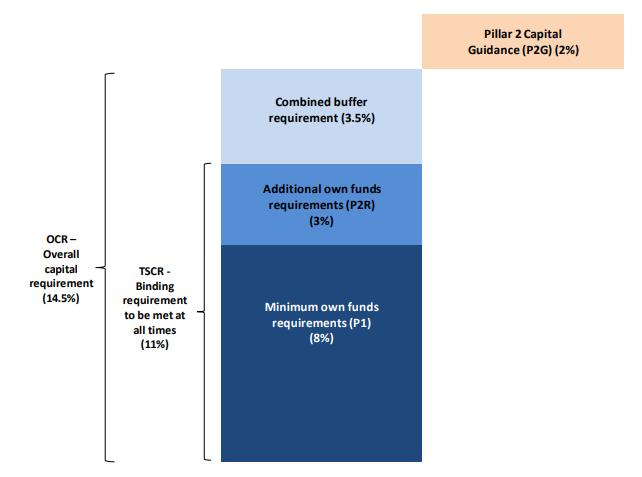

Competent authorities should determine through the SREP capital assessment whether the own funds held by the institution provide sound coverage of risks to capital to which the institution is or might be exposed, if such risks are assessed as material to the institution. Competent authorities could assess the risk posed by excessive leverage to the institution’s own funds, by considering the following:

1. Stability of profitability: taking into account the insights gained from the analysis of the business models of the institution, competent authorities could assess the extent to which the profits of the institution are volatile in order to identify patterns of excessive volatility as this might negatively impact the own funds of the institution. They could use risk indicators such as for instance: stability of return on assets (e.g. Sharpe ratio) and peak loss.

2. Stability of funding: taking into account the insights gained from the assessment of liquidity and funding risk, competent authorities could assess the institution’s reliance on short-term funding sources and the degree of liquidity of the assets held by the institution. They could use risk indicators such as for instance: high-quality liquid assets-to-total assets ratio, available stable funding-to-assets ratio, and / or deposits-to-assets ratio or other relevant indicators.

3. Stability of the business activity: taking into account the insights gained from the analysis of the business models of the institution, competent authorities could analyse the stability of the balance sheet and its individual core components (such as, for instance, loans) and the off-balance sheet items. They could use risk indicators such as for instance: standard deviation of growth rate of loans and / or standard deviation of growth rate of assets, volatility of the leverage ratio.

4. Degree of concentration: taking into account the insights gained from the assessment of credit risk, and considering concentrations in terms of leverage ratio exposure or other variables such as income or notional / nominal amounts, competent authorities could assess the degree of dependence of the institution on a small set of exposure classes, obligors/counterparties, or few business lines. In addition, they could consider concentrations in derivatives and other off-balance sheet exposures. They could use risk indicators such as for instance: share of primary exposure class or business line in total assets and off-balance sheet items and share of primary source of income in total income.

It would be beneficial to harmonise the structure of the minimum content of communication to institutions by providing a uniform template. This could facilitate not only the dialogue between the competent authorities and the institution, but also coordination within the groups of institutions.

Competent authorities should also form a view on whether existing own funds resources provide sound coverage of the risks to which the institution is or might be exposed. This view should be reflected in a summary of findings, accompanied by a viability score. The methodology comprises three main components:

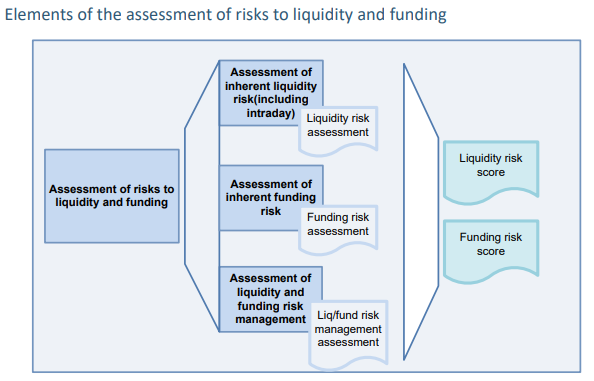

a. assessment of inherent liquidity risk;

b. assessment of inherent funding risk; and

c. assessment of liquidity and funding risk management.

The consultation paper aims to update, refine or introduce additional guidance on the following aspects:

· Application of proportionality principle

· Assessment of the risk of money laundering and terrorism financing

· Assessment of internal governance

· Assessment of risks to capital

· Assessment of liquidity and funding risk

· Determination of additional own funds requirements

· Assessment of risk of excessive leverage

· Communication of additional own funds requirements

The DACT supports the approach taken and feels important aspects to have reflected in these guidelines, are consistency, standardization and transparency for comparison and comprehensibility reasons.

In case you feel that the DACT can contribute in this process via webinars or an active exchange of information, please contact your DACT representative via:vaktechniek@dact.nl